Why, you ask are you paying 37%? Maybe you need a smarter tax accountant.

Vivek ramaswamy

Re: Vivek ramaswamy

“Avoid the foolish notion of hope. Hope is the surrender of authority to your fate and trusting it to the whims of the wind”.

Taylor Sheridan

Taylor Sheridan

Re: Vivek ramaswamy

Because you and the Mrs. have taxable income of more than $647,851?

Imjustheretohelpyoubuycrypto

Re: Vivek ramaswamy

I think the issue is that, in a saner system, there would be at least two more brackets to the right (or a comprehensive wealth and/or estate tax structure). I personally do not believe that higher tax rates at the far right reaches of the curve would really inhibit growth.

Re: Vivek ramaswamy

The question is whether they would have a real impact on the fiscal balance sheet. And the answer is, almost certainly, no. In order to do so, at current spending rates, increases would have to start at much lower incomes and be prohibitively high.jfish26 wrote: ↑Tue May 09, 2023 7:33 am

I think the issue is that, in a saner system, there would be at least two more brackets to the right (or a comprehensive wealth and/or estate tax structure). I personally do not believe that higher tax rates at the far right reaches of the curve would really inhibit growth.

Imjustheretohelpyoubuycrypto

Re: Vivek ramaswamy

And that's a static model that doesn't account for any tax avoidance tactics, etc.

Imjustheretohelpyoubuycrypto

Re: Vivek ramaswamy

This.jfish26 wrote: ↑Tue May 09, 2023 7:33 amI think the issue is that, in a saner system, there would be at least two more brackets to the right (or a comprehensive wealth and/or estate tax structure). I personally do not believe that higher tax rates at the far right reaches of the curve would really inhibit growth.

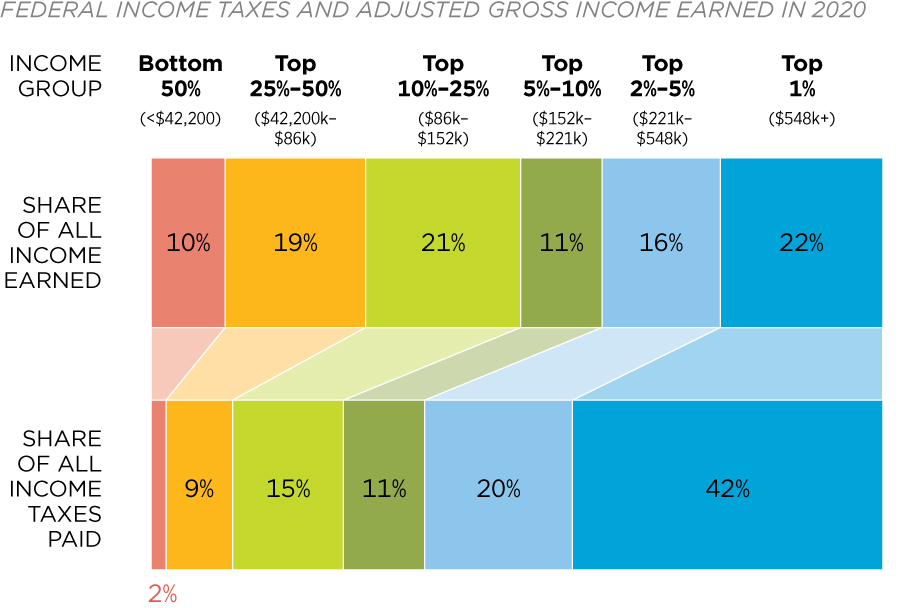

And that would extend that top blue section

There should be no issue whatsoever for the top 1% to be paying more ( well more ) than 50% of the nation's taxes considering the bottom 80% of the entire USA have below 7 percent of the nation's wealth and that the top 1% own more than 1/3rd of the country's wealth.

Re: Vivek ramaswamy

In 2020, individual taxpayers paid $1.7 trillion in individual income taxes.

In 2022, the top 1% gained 6.5 trillion in wealth.

Pump the brakes on solving the deficit with just taxes and say, hey, we can BOTH fix the broken tax system AND figure out more responsible spending within our government.

In this case, we're talking about tax distribution.

JFish nailed it on the head with this:

"Trying to address these issues WITHOUT starting at the right end of the wealth curve is like trying to address gun violence WITHOUT starting with access to assault rifles"

And of note, regarding your initial graph:

https://nymag.com/intelligencer/article ... taxes.html

"The first problem with The Stat is that it makes no reference to the proportion of income the rich earn. The juxtaposition between one percent and 40 percent is meant to convey the idea that a small number of people are carrying a gigantic and disproportionate burden, but the figure lacks any context when it omits how much money they earn in the first place."

"Second, and worse still, The Stat ignores the fact that income taxes are just one component of the federal tax system, and federal taxes are just one component of the total tax system...The Stat is technically limited to income taxes for a reason — it’s describing a narrow category of taxation that is especially progressive. But it only works because it makes the listener believe it describes all taxes. The trick works so well it fools the people repeating the stat."

In 2022, the top 1% gained 6.5 trillion in wealth.

Pump the brakes on solving the deficit with just taxes and say, hey, we can BOTH fix the broken tax system AND figure out more responsible spending within our government.

In this case, we're talking about tax distribution.

JFish nailed it on the head with this:

"Trying to address these issues WITHOUT starting at the right end of the wealth curve is like trying to address gun violence WITHOUT starting with access to assault rifles"

And of note, regarding your initial graph:

https://nymag.com/intelligencer/article ... taxes.html

"The first problem with The Stat is that it makes no reference to the proportion of income the rich earn. The juxtaposition between one percent and 40 percent is meant to convey the idea that a small number of people are carrying a gigantic and disproportionate burden, but the figure lacks any context when it omits how much money they earn in the first place."

"Second, and worse still, The Stat ignores the fact that income taxes are just one component of the federal tax system, and federal taxes are just one component of the total tax system...The Stat is technically limited to income taxes for a reason — it’s describing a narrow category of taxation that is especially progressive. But it only works because it makes the listener believe it describes all taxes. The trick works so well it fools the people repeating the stat."

Re: Vivek ramaswamy

Again, that's fine, but it's a political argument, not an economic one.

The tax code is decoupled entirely from spending. It is a conglomeration of political carrots and sticks. It is the means by which politically favored constituencies are rewarded and politically disfavored constituencies are punished.

The tax code is decoupled entirely from spending. It is a conglomeration of political carrots and sticks. It is the means by which politically favored constituencies are rewarded and politically disfavored constituencies are punished.

Imjustheretohelpyoubuycrypto

Re: Vivek ramaswamy

Not much argument here in the reality of the inner workings of our political system but i'd argue, at it's roots, it's very much an economical argument as well. There's just all that corrupt bloat ( and that very much includes the very top of the top earners behind the scenes of said political system ) between working theory and those roots.DCHawk1 wrote: ↑Tue May 09, 2023 8:19 am Again, that's fine, but it's a political argument, not an economic one.

The tax code is decoupled entirely from spending. It is a conglomeration of political carrots and sticks. It is the means by which politically favored constituencies are rewarded and politically disfavored constituencies are punished.

But still, lowering the tax rate for the bottom 99% and raising it for the top 1%, regardless of minimal impact because of that system, is the correct thing to do, and there's no reason not to be pushing for that. Sitting there and saying "it's all broken we can't do anything" does just that - nothing.

Re: Vivek ramaswamy

LOLpdub wrote: ↑Tue May 09, 2023 8:13 am

"Second, and worse still, The Stat ignores the fact that income taxes are just one component of the federal tax system, and federal taxes are just one component of the total tax system...The Stat is technically limited to income taxes for a reason — it’s describing a narrow category of taxation that is especially progressive. But it only works because it makes the listener believe it describes all taxes. The trick works so well it fools the people repeating the stat."

It is, indeed, limited to income taxes for a reason: because that's the way you measure taxes on income (duh). If you want to get into wealth taxes or capital gains taxes, you get into an entirely different and much more complicated debate -- not to mention one that is even more aggressively politicized. Taxing the "ultra-rich" on wealth or capital gains, while not taxing the not-ultra-rich on the same terms is likely unconstitutional and/or would constitute an effective bill of attainder.

None of this is as simple as "Tax those guys more!"

Imjustheretohelpyoubuycrypto

Re: Vivek ramaswamy

Ah.

Gotchya.

#triggered

Gotchya.

#triggered

Re: Vivek ramaswamy

That's political. Period.pdub wrote: ↑Tue May 09, 2023 8:22 am

But still, lowering the tax rate for the bottom 99% and raising it for the top 1%, regardless of minimal impact because of that system, is the correct thing to do, and there's no reason not to be pushing for that. Sitting there and saying "it's all broken we can't do anything" does just that - nothing.

Additionally, I have said neither that the system is broken nor that we can't do anything. Yur imagination continues to get the better of you

Imjustheretohelpyoubuycrypto

Re: Vivek ramaswamy

Of course it is political at it's base because that's where our taxes ( ALL TAXES OMG! ) are theoretically used to run the government.

I think what you're going to try and do here, which is trademark DC, is hunker down in some semantics argument between politics and economics and try and launch what you think are grenades out of your trench when they are actually just balloons full of luke warm air.

I think what you're going to try and do here, which is trademark DC, is hunker down in some semantics argument between politics and economics and try and launch what you think are grenades out of your trench when they are actually just balloons full of luke warm air.

Re: Vivek ramaswamy

Just clarifying what my particular issue here, that i'm arguing you with over, was this comment:

“…ultra-rich who don't pay their fair share" are entirely fictional.”

This is not fictional.

It is, by most Americans estimates on the distribution of wealth, reality.

But by all means, get down in the semantics trench, say things are unconstitutional when they break/challenge the current way things are, shift the argument to "what is politics and what is economics" ( not particularly helpful to the comment of ultra-rich who don't pay their fair share being fictional ), and lob balloons.

“…ultra-rich who don't pay their fair share" are entirely fictional.”

This is not fictional.

It is, by most Americans estimates on the distribution of wealth, reality.

But by all means, get down in the semantics trench, say things are unconstitutional when they break/challenge the current way things are, shift the argument to "what is politics and what is economics" ( not particularly helpful to the comment of ultra-rich who don't pay their fair share being fictional ), and lob balloons.

Re: Vivek ramaswamy

"Only in a land of widespread stupidity & sad gullibility would the 99% of people who don't make enough money to be affected by a wealth tax vociferously defend the handful of those who do, on the manifestly ridiculous notion that they too will one day be super-rich."

The Heisenberg Report

The Heisenberg Report

“We are living through a revolt against the future. The future will prevail.”

Anand Giridharadas

Anand Giridharadas

Re: Vivek ramaswamy

"The analysis from OMB and CEA economists estimates that the wealthiest 400 billionaire families in America paid an average of just 8.2 percent of their income—including income from their wealth that goes largely untaxed—in Federal individual income taxes between 2010 and 2018. That’s a lower rate than many ordinary Americans pay."

I only came to kick some ass...

Rock the fucking house and kick some ass.

Rock the fucking house and kick some ass.

Re: Vivek ramaswamy

Shit, I don’t think even 50% of the 1% have a good grasp on what things look like at the very top.Feral wrote: ↑Tue May 09, 2023 8:39 am "Only in a land of widespread stupidity & sad gullibility would the 99% of people who don't make enough money to be affected by a wealth tax vociferously defend the handful of those who do, on the manifestly ridiculous notion that they too will one day be super-rich."

The Heisenberg Report

Re: Vivek ramaswamy

And in this way, the fact that the top 1% pay 44% of all income tax…demonstrates JUST HOW MUCH wealth is accumulated at the far right end of the curve.PhDhawk wrote: ↑Tue May 09, 2023 9:26 am "The analysis from OMB and CEA economists estimates that the wealthiest 400 billionaire families in America paid an average of just 8.2 percent of their income—including income from their wealth that goes largely untaxed—in Federal individual income taxes between 2010 and 2018. That’s a lower rate than many ordinary Americans pay."